Medical Device Venture Capital

cultivate(MD) | Medical Device Venture Capital Fund

cultivateMD is a unique medical device venture capital fund.

We are unique because we leverage our many years of seasoned healthcare experience across all disciplines. This experience empowers us to come alongside exciting technology companies to positively impact their performance and results.

We focus on investing in technologies that improve outcomes and reduce costs from the healthcare system.

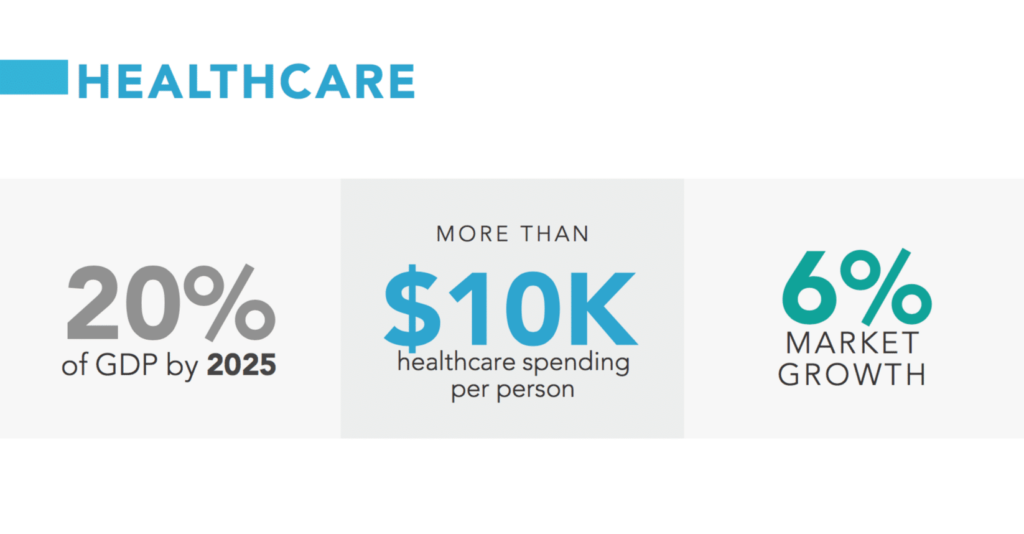

The healthcare and medical device space is a top area of focus, spending and high growth worldwide. This, of course, creates a very healthy and positive environment for strategic investors.

Our Healthcare Expertise Is What Sets Us Apart

We are a very focused medical device venture capital fund filled with 22 professionals–most of whom are technical engineers or scientists.

Beginning in 2014 our purpose was to raise additional capital to invest along with our own personal investment capital that we could deploy in the technologies we believe are most valuable with the intention that we could play a significant and beneficial role in increasing their value.

Since that time we have taken on a number of exciting opportunities including multiple very successful exits.

Reducing The Risk Associated With Medical Device Venture Capital

A big part of what makes us unique is that we believe we can reduce the investment risk by engaging in the actual operations of the companies we invest in.

We have a very effective means to deploy capital in an attractive way that can reduce risk by fully engaging the team that we’ve put in place. At the same time, we needed to infuse more capital in some of the businesses we had already engaged in order to continue to drive our success.

The cultivate(MD) Medical Device Investment Strategy

With our unique background and expertise, we are able to engage medical device companies at an earlier stage with a greater amount of confidence. This allows us to make investments at early–when valuations are much more attractive.

This also typically provides us with larger ownership percentages in companies–which enables us to have a greater role in the governance and operations of the companies we invest in.

This allows us to effectively mitigate the risk of ongoing or follow-on investments.

Deal Access and Capital Deployment

One of the most prominent challenges investors or venture capital firms typically face is not just fundraising–it’s getting access to the right deals in which to deploy those funds.

With our vast experience in the medical device space, we have an extensive network that provides us access to vet opportunities that are the best fit for our unique model and investors.

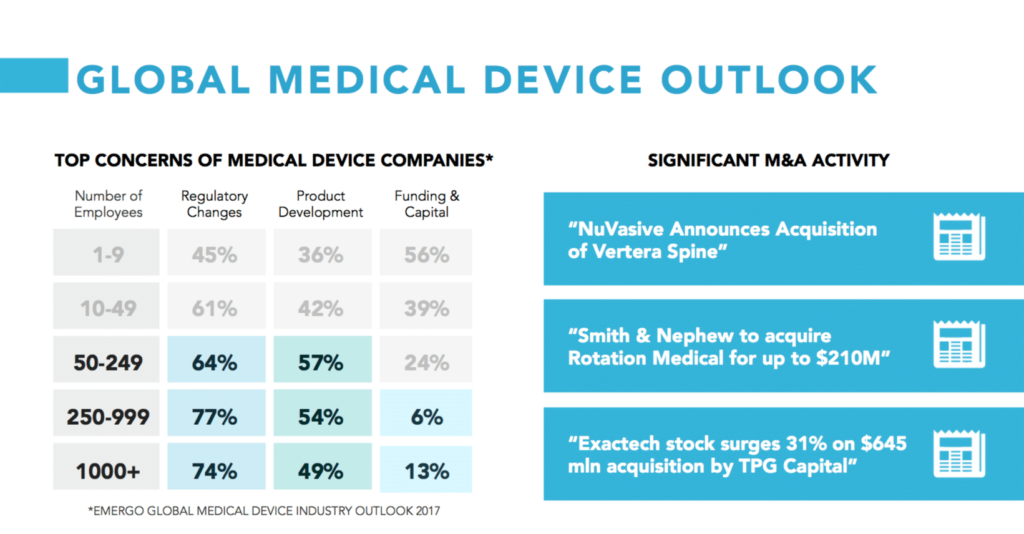

Additionally, many large medical device companies are offloading more development opportunities. This creates a wealth of opportunities for our team and us. These large, multi-national medical device companies have such a need for innovation, they are actively searching for opportunities that are pre-FDA filing, pre-FDA clearance, pre-revenue.

The material value can be derived from the innovation that takes place even before the asset is commercially ready or is de-risked. Frequently, those early stages are not very costly. There are many opportunities to create a lot of strategic value for not a lot of cash. From our many years in the medical device space and having the networks already established, we are able to quickly pursue and vet these opportunities.

Our deal access often comes at a very early stage, typically pre-Series A investments. Through experience, this is where we understand the strategy and can really leverage our multi-talented expertise.